From Safety Net to Solid Ground

How Social Security for All Fixes the Budget Without Spending More

Despite Congress spending $7 trillion a year, people who are working hard today are wondering whether Social Security will be there tomorrow. Families are relying on credit cards to make ends meet. And schoolchildren are being shamed for having school lunch debt.

For decades, Americans have been told that this suffering is inevitable — that helping people costs too much, that the budget is too tight, and that we simply can’t afford security for everyone.

Meanwhile, Congress increases the military budget year after year to over $1 trillion without hesitation, hands out corporate welfare freely, and grants endless tax cuts to the billionaires who need them the least. All of it drives the national debt so high that we now pay $1 trillion each year just to service it, not reduce it. The contradiction is impossible to ignore: we always find the money — just not for the hardworking people who keep the nation running.

Even when the government attempts to do the right thing, it overcomplicates solutions to the point of failure. There are dozens of overlapping programs trying to solve the same problem: making sure everyone can meet their basic needs.

People are divided by age, income, injury, family status, and job history, so the government can micromanage who qualifies for how much — and how they’re allowed to spend it. A nightmare of bureaucracy that causes millions to fall through the gaps.

Fragmented programs make it easier for politicians to claim credit without delivering results, for lobbyists to carve out exceptions, and for officials to quietly cut benefits without taking responsibility. A simple system that works leaves little room for political theater and demands accountability.

One program has the right idea.

What Social Security Gets Right

Social Security is simple, universal, and earned. It provides a basic income, rewards people for working, and does not add to the national debt.

The problem is that we limit Social Security to retirees and people with disabilities, while everyone else is pushed into a labyrinth of temporary, overly complex programs. We provide Social Security universally in retirement to millionaires and modest teachers alike, yet fail to make it robust enough to provide stability for those who need it the most.

The fix is to expand Social Security, so it’s there for everyone whenever they need it — and to eliminate the government bloat that makes many programs so richly ineffective.

We can do all of this without spending more than we do today.

How Social Security for All Would Work

Once you earn enough to support yourself, you pay income tax on the money you earn above that. If you don’t make enough to support yourself, the government pays you to ensure you can cover your basic needs.

This is known as a negative income tax. Below a certain threshold, the government pays you; above that threshold, you pay the government.

Under this system:

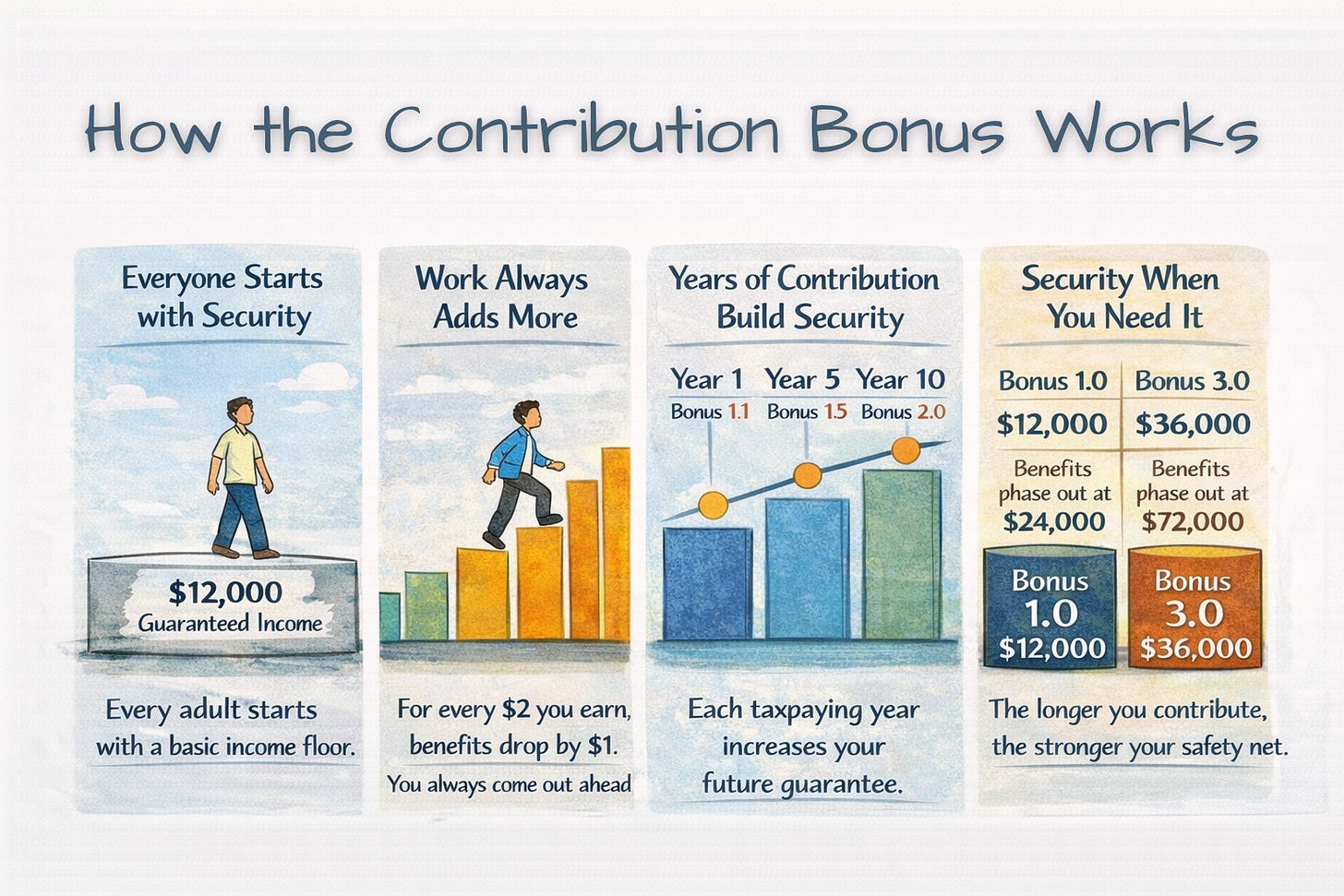

Every adult American is guaranteed $12,000 per year

For every $2 you earn, your benefit is reduced by $1 — it always pays to work

If you earn $18,000, your benefit is reduced by $9,000, meaning the government pays you $3,000, bringing your total income to $21,000

Payments are delivered monthly through the IRS

Once you earn $24,000, the benefit phases out completely, and normal taxes apply

This creates a solid floor, no matter how challenging life becomes, while retaining a strong incentive to work. Simple and effective.

But we need one more critical improvement.

Contribution Builds Security

Everyone should be rewarded for paying into the system that ensures society’s basic needs are met, and everyone should be able to retire after decades of hard work.

Today’s Social Security formula attempts to do this, but it is so complicated that most people have no idea how their benefits are calculated. It looks at wages across decades, selects subsets, applies adjustment formulas, and then modifies everything again based on retirement age.

Worse, it only helps you when you retire.

If someone has a difficult year at 40 — after paying into the system for 20 years — Social Security offers no support at all.

We can do better.

Everyone starts with a Contribution Bonus of 1.0. For every year you earn enough to pay income tax without receiving Social Security For All benefits, your Contribution Bonus increases by 0.1. That bonus multiplies your guaranteed income.

If you pay income taxes for 20 years, your Contribution Bonus rises to 3.0. You are now guaranteed $36,000 if you fall on hard times. Your benefit does not phase out until you earn $72,000, meaning even part-time work can make a meaningful difference in getting back on your feet.

The longer you support the system, the more secure your future becomes.

It’s about trust.

You contribute to your country knowing that it will be there for you in return — not just at retirement, and not only after tragedy. Whenever life throws you an unexpected challenge or opportunity, you have enough security to regroup, adapt, and move forward. That promise is what turns a safety net into the foundation of American prosperity.

One Program, Not Dozens

Government is very good at adding programs — and very bad at retiring them. New laws, new rules, and ever-expanding bureaucracy create complexity for its own sake, when the goal should always be simplicity and efficiency. We don’t need two dozen programs to do what one well-designed system can do better.

Under this system:

Social Security For All replaces the Earned Income Tax Credit

Federal and military pensions fold into Social Security

Unemployment insurance becomes unnecessary — income loss is covered automatically

SNAP, TANF, and housing assistance are replaced with cash that people can use for what they need most

Disability benefits are handled by adjusting the Contribution Bonus higher

Public and military service earn bonuses faster, rewarding service

Child Tax Credits are converted into larger bonuses for people with dependents, ensuring help reaches those who need it most

No micromanagement. No endless paperwork. Just one system with one goal: ensuring no one falls below a basic standard of living while rewarding those who carry the system forward.

The Bottom Line

Making sure every American can meet their basic needs does not cost more than what we already spend. Doing so rewards us with less bureaucracy, less waste, and a system that addresses the root causes of hardship instead of reacting after the damage is done.

A society that expects people to stand on their own must give them something solid to stand on. We already have the money.

The only thing missing is the will to fix a system that no longer works.

I like it. Simple and effective. Which means there is zero chance for the US to implement. And even less than that with the current ruling class.