A Return to Common Sense

“Society in every state is a blessing, but government even in its best state is but a necessary evil; in its worst state an intolerable one; for when we suffer, or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer.”

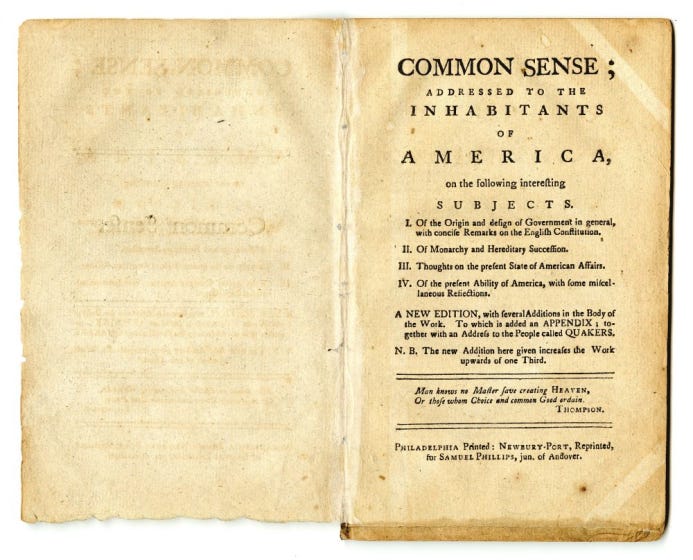

Thomas Paine’s Common Sense helped the colonies realize that government is meant to serve the people, not demand their subservience. It ignited a revolution and brought democracy to the modern world by establishing a government selected from, elected by, and working for the people.

Today, we have over 35 million living in poverty, 40 million relying on federal food assistance to survive, 750,000 homeless (with 15 million homes sitting vacant), and over 1/3rd of the nation skipping medical care due to cost. It seems we’ve forgotten the purpose of government, even though our Founding Fathers enshrined it in the Constitution.

First in the preamble:

“We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America.”

Again, in Article 1, Section 8:

“The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;”

That section directs Congress to provide for the general welfare of the nation and empowers it to collect taxes to pay for it. No, taxes are not theft, and anyone who suggests that it isn’t the government’s responsibility to ensure no one goes hungry, becomes homeless, or lacks medical care is ignoring our founding document.

The problem isn’t that America doesn’t have programs to help people; it is that we have a mess of complicated administrative overhead providing too little while costing too much.

Here is a list of federal aid programs designed to address housing and food:

SNAP

TANF

WIC

FMNP

NSLP

SBP

CACFP

SFSP

FDPIR

CSFP

CoC

YHDP

Section 8

Section 202/811

PATH

HOME

SSI

Social Security

If your income is between certain thresholds, you qualify for one program, and different thresholds for another. If you’re a student, there are programs for you, and other programs during the summer months. There are programs for older people, for people with disabilities, for parents, for people experiencing homelessness, and for all the ways you can divide up those in need into different groups to micromanage how they get and use their assistance.

This is an approach that breeds bureaucracy, drowns benefits in complexity, and never adequately addresses the problem. It is deliberate inefficiency created by the belief that we must control how any aid is used, because it must be the fault of those in need that they are struggling, not the system that allows such suffering to exist.

It isn’t that we can’t solve these problems, or that the solutions are too expensive. We can do so much more with the budget we have today. The solution needs to be effective and efficient, or as Paine wrote in Common Sense:

“the more simple any thing is, the less liable it is to be disordered, and the easier repaired when disordered,”

We know that people with incomes below a certain level are struggling. So why are we wasting resources by separating them into dozens of groups, all with slightly different rules and benefits?

We know that people who are making millions don’t need food stamps or housing assistance, so why are we draining Social Security to pay wealthy retirees every month?

What we need is a simple, effective solution to end suffering in America.

Every adult American citizen is guaranteed an income of $12,000 per year. This amount automatically rises with inflation.

We want to ensure there is a benefit to working, so for every $2 earned, $1 of benefits is lost.

That means the government compensates every adult earning less than $24,000 per year.

Every year that a citizen pays income tax instead of collecting a benefit from the government, their base benefit increases by 10%. This means someone who worked for 40 years without ever receiving income benefits now qualifies for a minimum income of $60,000. Retirees would be better off than they are today.

This is paid for by combining all federal food and housing programs into Social Security and removing the Social Security tax cap.

None of this is radical or new.

Famed economist Milton Friedman championed a negative income tax, in which the government paid people earning below a threshold, and those above the threshold paid income tax.

Over 50 years ago, one thousand economists wrote a letter imploring the government to enact a basic income.

Some politicians and advocacy groups have pushed for a Social Security for All program for decades.

Even Thomas Paine wrote about giving every citizen a lump sum upon reaching adulthood and an annual stipend to every citizen aged 50 or over.

Taking care of our fellow Americans is an idea that has existed since the beginning of our nation.

We know how to fix our government. We know how to make it work better for the people. We know how to end suffering. All we need is the willpower of the people to make it happen.

The government works for us.